EMEA Marketplace Landscape

When defining your marketplace strategy, it is paramount to account for all the right parameters. This post is providing a guiding framework to approach/engage and sell on marketplaces, helping you define the right business model.

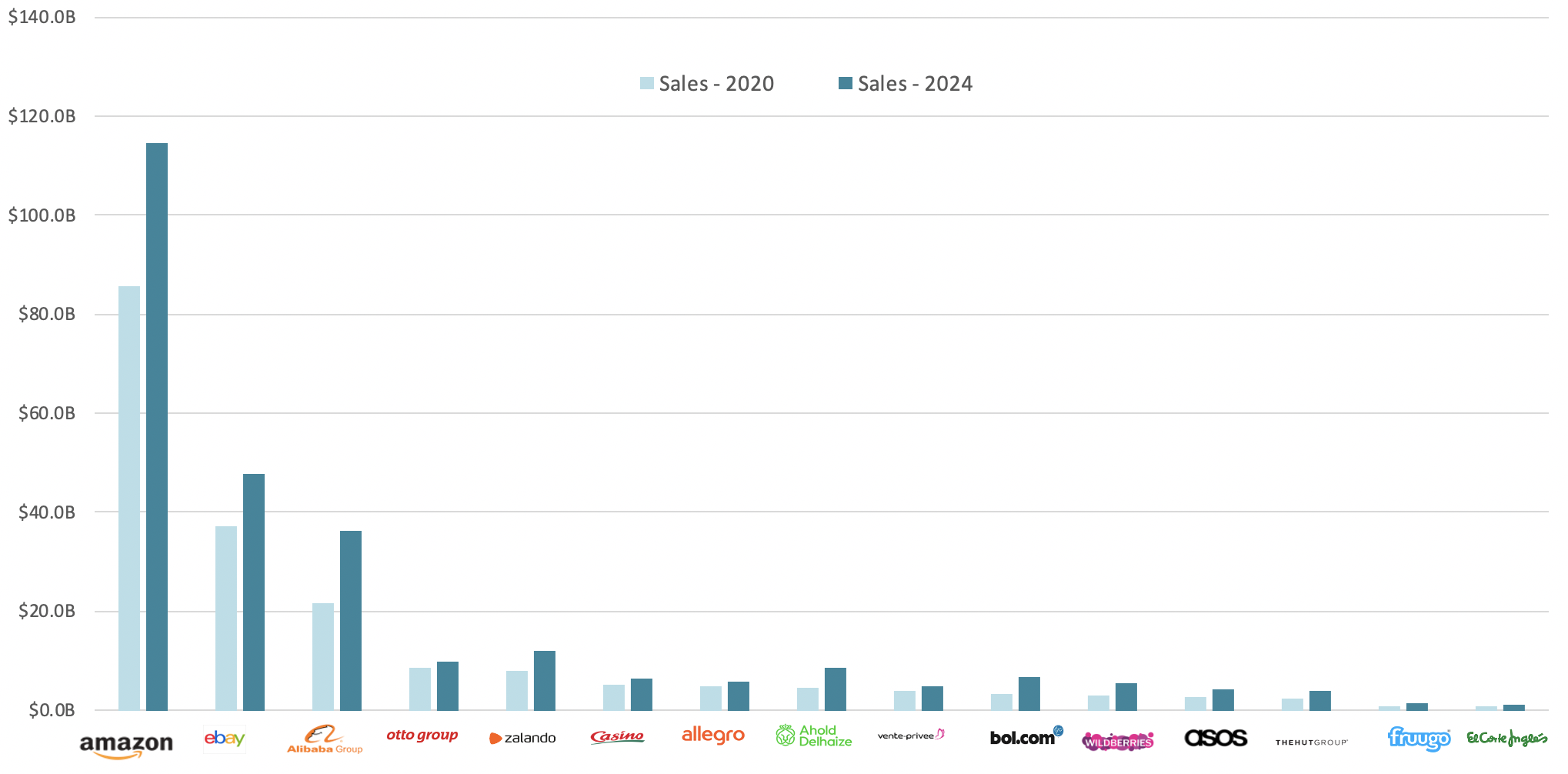

The growth of marketplaces has outpaced D2C businesses and is forecasted to grow again over the next 5 years (+39%). Amazon accounts for a ~60% revenue share of EMEA ecommerce marketplaces and reports 2.5m active sellers worldwide. Other players such as Wayfair, exhibit the strongest growth in the region (~87%), but players such as AliExpress and Wish come into play by introducing new business models and opening new cross-border trading opportunities.

European marketplaces use unified sellers’ accounts allowing to use the same seller account for selling in all marketplaces. 85% of Amazon.es marketplace sellers also sell on other European marketplaces. 81% of Amazon.fr, 80% of Amazon.it, 57% of Amazon.de, and 54% of Amazon.co.uk. Across all marketplaces more than half of sellers also sell on at least one other marketplace. Amazon UK is the largest marketplace in Europe and sellers have the option to send their goods to UK warehouses to then further sell them in multiple markets.

Sales coming from third party sellers (3P) on the marketplaces across Europe account for ~60% of the total sales for those marketplaces. This indicates a high potential for selling directly on European marketplaces (by acting as a seller or working with a third party seller), rather than acting as a vendor (selling products to the specific online marketplace who will act as the buyer, selling at its preferred price). Amazon is clearly moving into this direction as they started pushing more vendors towards their marketplace platform for them to act as sellers (limiting Amazon operating costs and mitigating their risks around counterfeit products).

There is a clear opportunity for European players to strengthen their selling proposition by exploring new operating business models and expanding into new marketplaces.

1. Top EU Marketplaces

*based on 2019 figures forecasted for 2020-2024 (PlanetRetail RNG, 2019)

2. Marketplace Research

Key Points & Questions to consider:

Research the market’s landscape and define a business case:

- Who are the key players in the region? Use the table above to evaluate marketplaces’ size, revenue and business models.

- Which category/ies are you willing to focus on? Depending on the category, use the table above to flesh out the more targeted/relevant marketplaces. Some clearly have dominant categories that account for most of their revenue.

- Build a Value framework for your short-listed marketplaces:

- $Sales

- Revenue model (cost of operating on a specific marketplace through commission).

- Traffic (#of visitors – unique/returning; traffic sources; demographics; consumer journey – active time on site, key pages).

- Marketplace CAGR over time.

Make sure you identify the most important ‘value KPIs’ as part of your strategy and try and assign ‘value scores’ to them in order to get an overall marketplace value score.

4. What is the dominant business model to operate on these marketplaces? Is it 1P? 3P? a hybrid model?

Make sure you evaluate what the best approach would be for a go-to-market strategy against your current resources and what steps you might need to take. Very often brands will work with specific sellers to serve multiple marketplaces or with 3rd party wholesalers. Brands may also decide to act as a seller and own the ‘vertical distribution value chain’:

- 1P model: this is the model where a manufacturer sells products to a marketplace, acting as a wholesaler, who will own the pricing and offering strategy (the marketplace is directly managing orders and shipping to end customers).

- 3P model: this is the model where a brand or manufacturer act as a direct-to-consumer seller (fulfilling orders from their own warehouse or using marketplace fulfilment services such as Amazon FBA), controlling their product offering and pricing strategy. This model can also be adopted by brands leveraging and intermediary wholesaler (partnering with a company who manages orders and shipping to end consumers) or working with a 3rd party re-seller (supplying wholesale to a company which manages orders and shipping to end consumers).

- Hybrid: a mix of a) & b).

5. What is the volume of cross-border sales? Will this impact your distribution model?

3. Marketplace approach – discovery toolkit

Connect with the marketplace for an initial introduction/meeting to evaluate how they operate and whether it may be a good fit for your brand. This will be the opportunity to confirm/strengthen any points reviewed in section 2.

Any final marketplace strategy should be formally defined after you have an idea for how you will be serving the marketplace (3rd-party distributor; wholesaler; 1P). Do not negotiate with a marketplace without having a feel for how you will be selling on their platform as they may try to aggressively ‘squeeze’ a best deal from you.

Connect with the marketplace

- Gauge the marketplace interest in your brand and ask for a proposal on their side to assess how they would on-board you.

- Who will be your main stakeholder on the marketplace side? Will you work with a business development manager who will help you grow your business? Will you be dealing with an account manager?

- Evaluate their key business model: is it predominantly 1P/3P/Hybrid? What does the split look like? Are there any dominant key sellers or wholesale distributors recommended by the marketplace?

- What would a go-to-market strategy look like for your brand in light of findings from point 2)? Start laying down an assumption on how you would distribute your products on the marketplace in question.

- Are there any competitors selling on this marketplace? Can you dig into their (competitors) go-to-market strategy?

- What are the minimum selling costs? Account for any commission, shipping fee and ask for an estimate on average costs if working with a 3rd party wholesaler or seller.

- What are the minimum selling requirements? Specifically, clarify any implication raised by taxation, minimum order quantities, digital shelf content requirements, operating timelines.

- How directly will you be able to influence pricing? What would be your level of control on pricing and the implications for any cross-border activity? Understand what the marketplace policy is towards their consumers and how strong is their push towards price competition.

- What are the inventory management and fulfilment options available? Outside of the 3P model, would you be able to act as 1P and sell products to the marketplace for them to fulfil the demand? Do they own warehouses and where? What is the return policy on purchased products? Understand how this would impact your stock management capabilities and what you would need to take into account for stock replenishment.

- What marketing tools are in place to help you support your merchandise sales? Explore options such as Shop in Shops; promo deals; key retail programmes; sales’ events; marketing campaigns. Ask questions about product search technology too: how do they surface products? What criteria do they take into account?

- What is the marketplace policy on data sharing? Specifically, clarify what data would be made available to you (if at all) on sales performance/volumes; customer journey and with what frequency.

- What is the marketplace policy on counterfeits and brand protection? Do they have programmes in place to protect your brand? What are they actively doing to monitor and fight counterfeits?

Connect with a seller – ‘Super’ seller approach

- Analyse the sellers’ landscape on the specific marketplace, by category/region to understand whether a single seller may be leveraged to expand your range across multiple categories /marketplaces. Alternatively, you may have to leverage a portfolio of sellers, each specialised in a specific category/market. From initial Amazon results, it appears that for categories like Apparel the sellers’ base is more fragmented than for Electronics/Toys.

- Evaluate whether you will be owning the relationship with a specific seller? Or whether the marketplace will be liaising with specific sellers to expand your range or any top sellers that may not yet be available on the specific marketplace?

- Explore options to possibly work with professional sellers who are not category-specific. Top sellers on Amazon will supply the marketplace with a wide variety of goods that make it the ‘everything store’. 3% of the top sellers on Amazon generated more than $10m in 2018 and 19% of marketplace sellers brought in more than $1m in sales (+10% YoY).

- Leverage any Amazon seller to possibly cover and expand to other marketplaces. 80% of Amazon sellers also cover other channels; this is driven by the fact that the Amazon marketplace is constantly changing, bringing competitive risks, but also to the rise in Amazon owned labels. 38% of Amazon sellers state that the competition from Amazon private labels is their biggest worry.

- Evaluate the cost model for selling on marketplaces via a professional seller or by becoming a seller. Consider: referral fees; sales commission; fulfilment costs; stock management costs. See this guide on Amazon.

Connect with a distributor (Middleware solution) – Outsourcing Distribution, Fulfillment

- If you are new to a market and may not have the resources or budget to fully establish a new distribution network and supply chain, you might consider working with a distributor locally/regionally to fulfil your marketplace orders.

- When evaluating a potential distributor, take into account the following criteria: geography; what products does the distributor have in stock; stock management fees; orders fulfilment turnaround; customer service.

- Establish whether you would be handling the drop ship or whether your distributors would cover fulfilment on their side.

- Evaluate whether you could introduce any solution to facilitate data feeds to a distributor to sell your products online, thus ensuring accuracy of product information.

- Evaluate whether working with a seller already connected to a specific distributor would be an optimal solution. Provided a seller already has a well-established relationship with a distributor, you could leverage that to increase your product reach into a new distribution network.

Connect with a marketplace management provider – Marketplace Integrator

- If you’re looking to grow and scale your overall marketplace offering, it may be worth evaluating marketplace management providers:

- They will allow you to connect with multiple customers across a global array of marketplaces through a centralised system.

- Your product data will be ingested once and subsequently harmonised across multiple marketplaces.

- You will have a chance to tailor promotional activities per region, while offering a fully optimised experience to your customers.

- This is an ideal solution to mitigate any pricing issues as you will have the opportunity to review your pricing across multiple marketplaces from a single location and define how price will be managed on specific markets.

- This solution will offer a greater reach, while managing your offering from a centralised solution. Furthermore, your product data will be harmonised for every marketplace accordingly.

- Companies are emerging as key players in specific markets and start to offer fully integrated PIM and order management solutions.

4. Marketplace due diligence

Before finalising any contractual agreement to sell on a new marketplace, some due diligence should be included as part of your ‘business plan’.

Research:

- The company history;

- The company ownership structure;

- The company trading history;

- The company growth forecasts and geographical expansion plans;

- The company competitive environment;

- Any in-market risks linked to political factors, trading policies, foreign investments;

These are all factors that will impact your long term growth plan and any joint planning with 3rd party sellers or wholesale distributors.

5. Evaluate and define a marketplace selling strategy

After reviewing the marketplace landscape and evaluating the possible go-to-market strategies, a selling strategy should be formalised around a chosen marketplace. Ensure you have a defined strategy for each key marketplace platform and not a one-size fit all approach. Define your strategy against the following pillars:

- Operating model: 1P/ 3P/ Hybrid.

-

- Evaluate whether entering the new market as a wholesale vendor (1P) or by becoming a seller (3P) (either by acting as direct seller or through another existing seller/wholesaler) is the best approach.

- Advantages for moving to a 3P model are related to owning control over the product catalog and pricing strategy or by working with 3rd party sellers who already have a selling history and experience in the market, but who may also offer growth opportunities in other markets where they currently operate. A 3P model provides more control on pricing and the inventory selection which is not dependent on any retailer’s choice.

- Entering a new market as a 1P vendor often allows to find an entry point and gain some insights on consumers and products’ sales. Under such a model, it may be recommended to focus on top selling and high performing products which would help strengthen the brand’s position and reputation. Furthermore, under a 1P agreement, the retailer would handle the warehouse management (stock management) and all orders’ fulfilment.

- A hybrid model may be considered as a learning opportunity and as a way to initially raise awareness for and protect your brand. Going 1P may act as your initial entry-point and as the chance to get to know the consumer; while going 3P would allow you to exert control over your prices and catalog, thus reducing operating costs and mitigating any risks to ‘squeeze’ margins.

Managing a hybrid model, will require data consistency and a reliable source of truth for any product catalog, content, inventory and pricing.

2. Contractual agreements: what would be contractually required with the marketplace or any 3rd party seller/wholesaler/distributor.

3. Product catalog: define the size of the catalog to be sold and the selection. Criteria like pricing, commission, competitive landscape, taxation will all have an implication on your selection.

4. Pricing Strategy and pricing protection: setting the right pricing strategy will ultimately determine your competitive position, but also your brand positioning on a specific marketplace. Specifically, consider the following when defining a pricing strategy for a new marketplace:

- Price Parity: ensure that your products are offered at the same price as on your other online channels (the product should be at or below the lowest total price offered on any other online channel).

- Manufacturer Suggested Retail Price: ensure you have a monitoring tool in place to make sure the minimum suggested price is protected. Work with the licensees to establish these figures early on. Don’t rely on the marketplace to honor these prices as they will leverage pricing monitoring tools to match any other lower price on the market.

- Product Performance: monitor the performance of your products over time and adjust pricing accordingly to boost your lowest performers and leverage your top selling products.

- Competition: monitor your competition’s pricing strategy and pricing trends.

- Contractual agreements: pay attention to any marketplace agreements’ details on pricing and ensure these are reviewed early on.

- Centralize your marketplace management: having a centralised approach to serving your products to multiple marketplaces will facilitate creating a uniform pricing strategy and easily spot minimum pricing violations.

- Repricing: ensure you leverage any ‘repricer’ that will monitor issues with price parity across multiple marketplaces.

- Leverage Deals & Promotions: deals and offers represent a good chance to put your products in front of a customer by being price competitive and subsequently acquire a new customer base.

- Flexible Pricing: leverage dynamic pricing to adjust to consumer demand and seasonal purchasing trends.

- Bundle Opportunities: similarly, as for deals & promotions, bundling products into a single SKU will make your offer price competitive and might generate an even bigger sale.

5. Category selection: define which categories you will be focusing on based on your selected marketplace. Take into account the competition’s and your current selection. Consider frequency of new product releases and stock replenishments. Look at the ecommerce growth for the next X years in a specific category and any risks associated to it (production, competition).

6. Breakeven / DCF analysis: build a financial analysis around your new go-to-market plan, evaluating all costs against forecasted revenues to understand when you will be expecting to reach growth and financial return on investment.

7. Content syndication: what would be required from a digital content perspective? What investment would be required on your side to sell your products on the new marketplace?

8. Any other legal constraints / legislative steps that would be required on your side before selling on the marketplace.

9. IP / Counterfeit management strategy. Ensure you have tools/teams who are protecting your IP and trademarks.

6. Launch Toolkit

- KPIs / Success Metrics

- Sales

- Traffic

- ATV, UPT

- Digital shelf package:

- Product identifiers (EAN, SKU)

- Digital copy (including SEO keyword research and translations)

- Product Set Up sheet + guide

- Digital assets (product silos, pack shots, in-use shots, lifestyle shots, videos)

- Product shelf life and stock availability

- Marketing planner:

- Marketing budget allocation

- Marketplace marketing calendar

- Brand marketing calendar

- Marketplace promotional/sales calendar

- Search strategy:

- Always On marketing plan on marketplace

- Always On marketing plan off marketplace (Google Shopping, Criteo,…)

- SEO keyword research

- IP / Trademark Protection list

- Resources:

- Market intelligence data (sales forecasts, growth forecasts, …)

- Consulting companies (content syndicators, PIM platforms)

- Physical Resources

- $ Budget