Direct-to-consumer online models have been growing extensively over the past months, driven by new needs for brands to reinforce and build their online presence. The US direct-to-consumer ecommerce market is expected to be worth $21.2B by 2021 with a 20% growth year on year and 40% of US internet users are expected to be purchasing 40% of their online shopping through D2C companies in the next five years.

With the unprecedented ecommerce growth driven by global lockdowns, companies and brands have looked for opportunities to diversify their revenue streams and create new value for their consumers through authentic online experiences. Bypassing third-party retailers and distributors, brands have decided to own their supply chains and build a direct relationship with their customers to drive retention and long-term loyalty.

Additionally, tools and platforms offering flexible systems’ integrations, powerful analytics and quick-to-implement selling solutions are reinforcing opportunities for brands to directly engage with their customers, improving their shopping experience and gather insights at every digital touch point along the purchasing journey.

Through direct-to-consumer online models, brands can expand their presence into new markets and scale globally, creating new revenue channels and adapting to evolving consumer needs.

Brands adopting direct-to-consumer models can generate several benefits, especially increasing revenue generation through innovation, personalisation and customer experience.

However, the increasing competition from more fragmented CPG segments and the ease to launch new businesses online will not necessarily guarantee success and long-term viability if brands don’t ultimately include their D2C strategies within wider omnichannel models.

Key Business Benefits of Direct-to-consumer models

Revenue Increase

Brands can increase engagement and optimise their online conversion rates by offering customisable, personalised, targeted experiences through their online branded stores. They can also provide more sophisticated customer support to build loyalty and retention. Additionally, brands can generate greater profit margins as they don’t need to fight for their own product placements and positioning by investing into brand awareness or performance campaigns when selling through their websites. Vertical integration through the ownership of supply chains, distribution and manufacturing is an important factor in leveraging increased margins when evaluating and building direct-to-consumer propositions.

Expanded Market Reach and Speed-to-market

Direct-to-consumer websites allow brands to decide on their preferred market reach and on how to scale across geographies. For brands who already have established international supply chains, having their own direct-to-consumer web store gives them an additional trading presence that can reinforce their omnichannel strategy. Not needing to have distributors with a global reach, brands can easily scale globally through direct-to-consumer solutions, owning their vertical supply chain. This can have significant impact in developing and optimising cross-border trade in an ever-increasing borderless online economy.

Reduced capital expenditure

CAPEX investments can be reduced when expanding across geographies through online channels because the costs involved in opening brick & mortar stores can be used instead for less costly digital channels’ investments with minimised operational risks. Additionally, as witnessed with digital native brands, alternative physical models can be explored to reinforce the ‘experiential’ value of physical retail through pop-ups and limited partnerships which minimise the long-term investments to build and sustain established brick & mortar destinations.

Improved customer data

Brands who sell direct can leverage the breadth of first-party data accessible through and generated by digital tools and advanced analytics’ suites incorporated within selling platforms. They can better understand their customers’ preferences, demographics, path-to-purchase in order to address and optimize any pain points along the customer journey.

Customer acquisition and customer relationship

Owning and operating their D2C website allows for brands to build direct relationships with customers and acquire new ones through their preferred acquisition strategy, without being dependent on 3rd-party retailers. Brands can leverage their ability to build one-to-one relationships with their consumers and incentivise community-building around their product offerings. Those direct relationships and communities can provide valuable information and dialogues between brands and customers that can generate co-creation for new products and services.

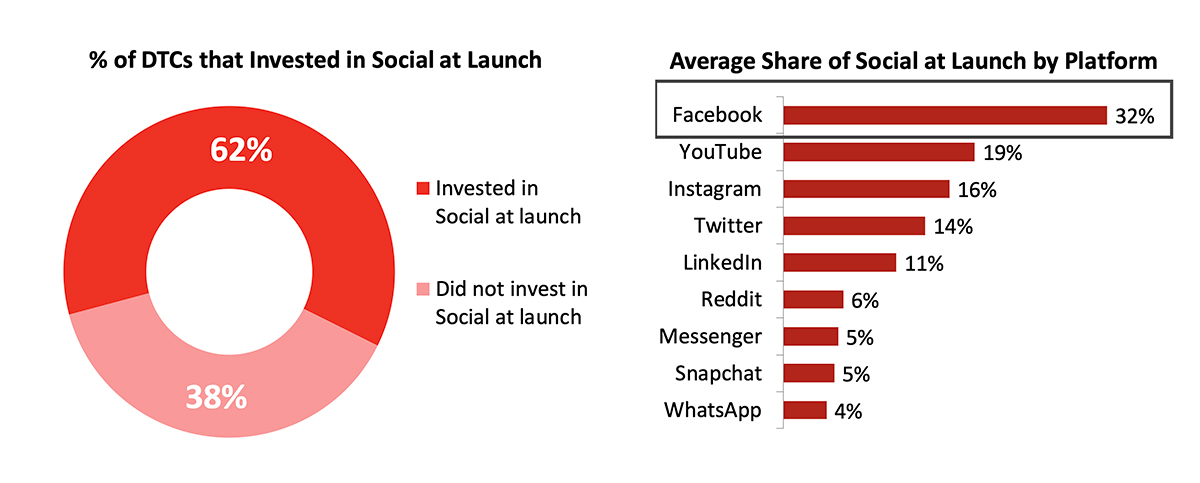

The growth and opportunities represented by social commerce are an important component of acquisition strategies for D2C brands. Social networks represent a key component of the consumer journey, especially in the product discovery phase, but they become increasingly significant along the whole shopping funnel as new seamless shopping and checkout functionalities are introduced. 62% of global D2C brands invest in social marketing at launch and 32% of them invest in Facebook campaigns during their initial operating phases:

iab.com, Direct Brands: Media & Customer Acquisition, 2019-2020

Comprehensive product offering and personalization

The past decade in retail has seen an important shift; one towards customer-centricity in which the shopping experience is tailored to what is convenient and easy for the consumer, rather than the retailer.

Brands adopting direct-to-consumer models can best adapt their product assortments to consumers without being restricted by third-party retailers and decide to offer their full catalog without limitations to address a wider customer audience.

Personalization can be maximised to deliver a highly tailored and authentic online experience aimed at addressing specific consumers’ needs.

The table below provides insightful information on the key dimensions that characterize retail models and the comparison between traditional and digital solutions. Digital D2C solutions offer key advantages as well as agility and flexibility:

Deloitte, Going digital, going direct, 2020

Deloitte, Going digital, going direct, 2020

Direct-to-Consumer done right and digital native brands

Some brands have opted for online direct-to-consumer models as their primary go-to-market strategy, becoming true digital native players. Brands like Bonobos, AllBirds and Glossier have leveraged the power of personalization and customer relationship to build digital-first brands, delivering products directly to consumers and pivoting into the distribution model.

Digital native brands have been able to acquire and retain customers by directly engaging with them and by looking for unique opportunities to build that engagement, revealing their authenticity and being transparent about their brands.

These models have been facilitated in the past few years by a growing importance in the role played by social media channels in ecommerce and in the product discovery phase of the consumer shopping journey. The importance of influencers’ marketing has also played an important component in the growth and adoption of digital native brands, giving birth to new brands launched by key influencers such as Kylie Jenner’s makeup range.

The growth in global ecommerce in 2020 (expected at 30.4%) has also played a key role for more traditional retailers to adopt online sales’ channels and very often new direct-to-consumer models.

With less dependency on 3rd-parties and less limitations on branding, fulfilment and distribution, D2C models can offer several benefits as seen above.

This makes them attractive models for new brands as well as more established brands looking to grow their online presence while building a solid relationship with their customers and monitoring the consumer journey.

There are some key conditions that appear to be met by successful direct-to-consumer models in a space where the consumer becomes more demanding and ‘hungrier’ for convenience and dedicated attention:

Authenticity & Transparency

In today’s hyper-connected ecosystem customers value authenticity and transparency, often choosing brands they feel an affinity with and a true respect for. This covers brands and companies’ ethical behavior, sustainability, authentic communication and business transparency.

Specifically, newer connected generations like Millennials and Gen Z have a sharp eye for inauthenticity, and D2C brands have responded. There is more transparency in retail than ever before and D2C brands are leveraging every channel available to communicate the core of their operations and business models: from sustainability to longer-term focus but also from customers’ feedback consideration to constant product improvement and personalization.

Allbirds is a great example of a digital native brand showing a high level of transparency into their business operations. Their business model is focused on sustainability and societal value. The company went carbon neutral in 2019 and they encourage people to think about the environment in a broader way, by creating ‘educational’ sections on their website which aren’t focused on transactional goals. They encourage their community to look for new ways to contribute to lowering the carbon emission and they’re very transparent about the projects they undertake, always ‘giving back’ to the environment. The open, authentic and honest communication has been a critical factor for Allbirds to reinforce their online community and grow their base with online shoppers who share similar values and who have the same environmental and ethical concerns.

Personalization

What makes direct-to-consumer models especially attractive is the possibility to offer highly personalised experiences through shopping and product personalisation.

Remembering one’s past purchase or browsing history and offering tailored shopping recommendations through search, cross-selling and up-selling is one of the benefits of D2C brands. Some would encourage customers to login into their account to offer seamless pre-populated checkout processes and product recommendations based on pre-selected favorite products’ attributes.

Product experience personalisation is another advantage of D2C, especially popular with gifting propositions where the shopping experience can be fully tailored and personalised by occasion, target audience, available budget.

Digital-first

The constantly evolving digital ecosystem is a catalyst for D2C brands looking to stay abreast of industry trends and ahead of the competition. The importance of building a strong online presence and engaging with customers at multiple touch points has made social media channels particularly interesting to reach new audiences, build online brands and generate incremental revenue. Latest innovations like Facebook and Instagram Shops with integrated checkout solutions provide additional avenues for brands to communicate with and reach consumers online. The importance of mobile and visual media also means that D2C online brands need to think about digital-first when designing their online experience and adapt to the online shopper. Convenience and personalisation are key factors that also drove the introduction of new technologies such as AR and AI to provide more engaging and better online shopping experiences. Digital wallets are also pushing for D2C websites to provide more seamless checkout processes, while offering a variety of forms of payments to adapt to different customers and geographies.

Similarly, the digital marketing of brands and products has been impacted by new channels and new influencers acting as brand ambassadors.

Glossier has been an innovator in the beauty industry, leveraging digital-first channels to market their products and communicate with their consumers. Born out of a beauty blog, the brand was established listening and responding to a new age of consumers. Gen Z and Millennials have become very reliant on and comfortable with online products’ recommendations from vloggers, influencers, peers and other online consumers from the community.

Glossier has emerged as an approachable brand; listening to what customers want and relying on superfans to become brand ambassadors and trusted micro-influencers. Glossier’s social media content strategy positions the brand as authentic and down-to-earth. By using authentic and genuine language, it’s as if Glossier wasn’t just a brand, but another friend’s Instagram account.

Community & Engagement

D2C brands have largely invested into building, growing and nurturing their online communities and fan bases. The need for consumers to feel aligned and connected with brands they adopt, has led to a strong willingness to belong to social communities with similar taste, interests and values. Brands have put substantial emphasis on customer reviews, feedback and satisfaction rates to continuously optimise their online shopping experience; their online customer service and their product development.

Similarly, brands have spent time engaging with their communities, driving retention and loyalty.

Nike decided to stop selling their products on Amazon last year in a bold move to start focusing on their D2C strategy instead. The brand decided to focus its investments towards its community and establish a direct dialogue with their customers to better serve them and better respond to their needs. Nike has been seeing tremendous success with its direct-to-customer business, with the Nike and Sneakers’ app driving 38% of their digital growth in Q2 2020. This comes after initial success of their digital business in 2019 which grew 35%, as the company expanded their NikePlus membership base to 170 million active members.

Innovative ecommerce platforms

The emergence of quick-to-implement Saas solutions for direct-to-consumer ecommerce has been an important factor in the increase of D2C online stores across brands. Both for brands exploring online for the first time or brands looking to quickly build a digital presence leveraging the opportunities generated by the pandemic.

Cloud hosted solutions such as Salesforce Commerce Cloud, BigCommerce and Shopify have positively contributed to the growth of D2C online propositions thanks to their cost efficiencies; integration flexibility with a multitude of other service providers; and their global scalability.

This flexibility has allowed very established brands to continue to leverage their existing distribution channels and fulfilment solutions while launching their online stores on these platforms. Additionally, existing ERP, content management systems and product information databases can also be integrated with these platforms, simplifying the information and content feed flows.

Shopify

Shopify is now one of the leading ecommerce solutions globally, with more than 1M active websites. A preferred solution for smaller merchants, it's often been compared to a marketplace, but wrongly so. Offering substantial flexibility, Shopify relies on a multitude of integration APIs available to customise online stores to the preferred settings. Better suited for small / medium-sized vendors, it is recommended for products with a relatively low level of complexity (such as apparel).

However, what Shopify brings is a very quick turnaround to build online stores at an affordable price. Lindt took advantage of this solution to create a transactional online store in Canada during the pandemic in just under a week.

BigCommerce

BigCommerce is the other fast growing Saas solution allowing brands to build large scale online stores with a very flexible portfolio of integration APIs that support multiple forms of payment and content management systems.

Better suited to larger manufacturers, it already offers several integrated features to manage customer reviews, to customize product pages, and to provide real-time shipping quotes.

Better suited to create more sophisticated, detailed and personalised stores it is often preferred to sell more complex products. Younger than Shopify, the company is still growing its ecosystem of developers and designers.

Salesforce Commerce Cloud

Salesforce Commerce Cloud is a solution that’s been present in the industry for quite some time and the more mature among the three. Born out of a Salesforce acquisition of Demandware, it serves quite established brands and enterprises with highly customizable plans and on-demand pricing models. Agency’s development work to customize the platform and optimize it is usually more expensive than it would be for BigCommerce or Shopify, but the platform can scale globally with fully integrated multi-language, multi-currency checkout and localised payment methods.

All solutions are truly comparable and highly efficient to launch and create sophisticated, innovative, global and personalised online D2C propositions. They all offer different benefits targeted at different types of industries and customers, but they all offer fairly easy and affordable solutions that allow brands to easily create online stores.

Different levels of sophistication are available to more or less ambitious companies with greater or more limited investments’ budgets.

The accessibility to online D2C solutions provided by these tech-enabling Saas companies is a key catalyst in the quick growth of direct-to-consumer stores and particularly in the quick online launches witnessed during the pandemic.

New Categories joining the direct-to-consumer space

Covid-19 has massively accelerated the need for direct-to-consumer models as consumer shopping behaviours quickly shifted towards online and towards more efficient delivery solutions.

Brands operating in categories that until now were heavily reliant on more traditional brick & mortar distribution channels quickly focused their energy and investment to develop and expand their online D2C strategies.

CPG and FMCG companies, specifically, have emerged as the latest big investors into D2C solutions. While the importance of owning a D2C proposition has always been recognised by the CPG industry, several brands were reluctant to move into this space because of investment and operational reasons such as: fear of channel conflict; compelling consumer value proposition; need for developing new internal capabilities; operational costs.

Despite these apparent challenges, larger CPG / FMCG companies were forced to enter the space to counteract smaller, more agile competing brands and capture the higher consumer demand generated by the pandemic.

PepsiCo recently launched 2 new D2C websites: Snacks.com and PantryShop.com. The two destinations offer a chance to consumers to directly purchase from the supplier rather than through a third-party distributor.

The product offering has specifically been tailored to meet current consumers’ demand as shaped by the pandemic, focusing on product bundles and essentials that tap into home working / homeschooling consumer needs. Customers also have a chance to easily purchase their favorite food and beverage products, conveniently from their home.

Kraft Heinz also entered the D2C space in the UK through a new website called Heinz to Home to sell and deliver some of their popular product ranges like canned food and soups.

Even more seasonal products like Ben & Jerry’s ice creams are being shipped online through their D2C online store where customers can enjoy their favorite pints or taste the Netflix & Chill’d flavors.

Nestlé also expanded their D2C model during the pandemic, securing a partnership with Deliveroo in the UK to make several of their favorite brands conveniently available to consumers through the Deliveroo App. Brands like KitKat, San Pellegrino, Nescafé were all part of the offering to address some of the consumers’ needs around essentials and groceries.

Lindt Canada is another example of a brand who very quickly reacted to the challenges and opportunities presented by Covid-19, launching their first Shopify D2C online store. They leveraged their established and large distribution network to centralise their online orders’ pickup hubs into their biggest brick & mortar stores which were closed. Quickly building a presence online and uploading their product catalog, they managed to launch in less than a week with an online catalog that could be purchased online and picked up in store to clear some of their excess, unsold retail inventory.

Brands like PepsiCo, Kraft Heinz, Nestlé and Lindt have quickly realised the importance of remaining relevant and building a sustained presence within the online retail ecosystem of the future which has been quickly shaped by the latest global events.

The pandemic acted as a catalyst for the industry to rapidly transition to digital and online as the only viable way forward.

This is likely a strategy that will persist amongst larger brands who can sustain operational investments, leverage their distribution and fulfilment network and invest into talent and internal upskilling.

Future Outlook

Brands leveraging direct-to-consumer solutions are facing increasing challenges generated by fragmented competition as well as specialty brands occupying dedicated niches.

Additionally, some of the tools that benefit digital native brands such as social channels and influencer marketing can only scale to a certain point and increasingly act as incremental revenue generators rather than disruptive business solutions.

This has partly led to a shift towards physical retail, even for digital native brands who are leveraging physical experiential locations and pop-up stores to complement their online, mobile, social presence to create omnichannel solutions.

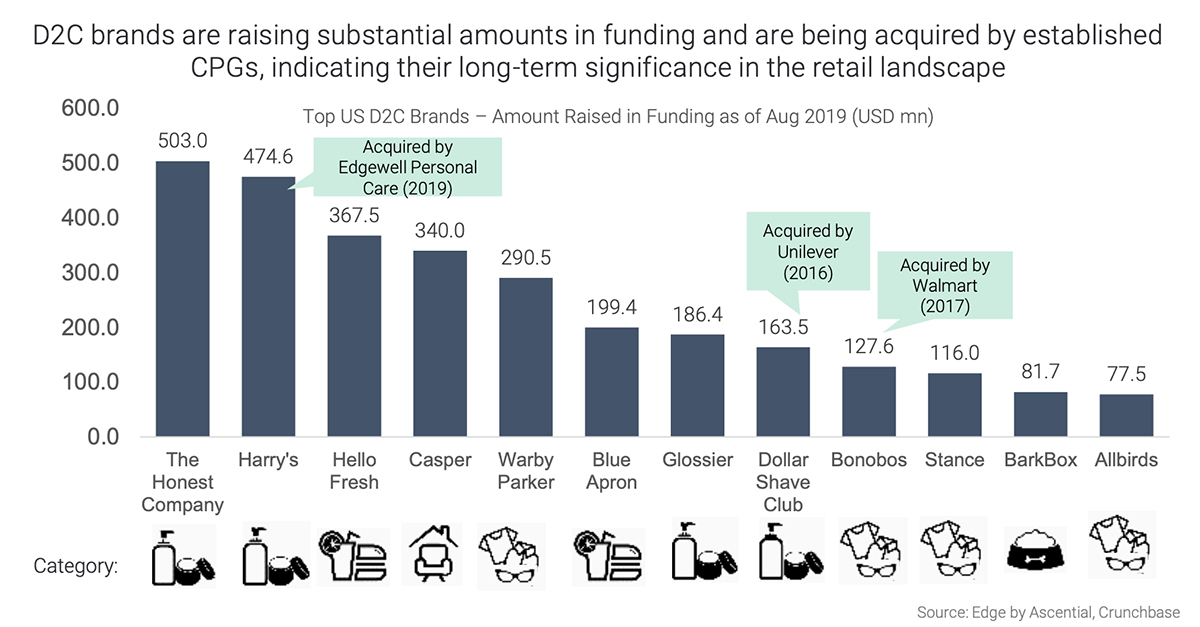

The investment landscape into consumer brands has also changed over the past few years. Venture capitalists have been focusing their investments on sustainable growth and profitability rather than purely on revenue generation. This new trend, coupled with an increased competition for venture dollars from consumer companies, has made it more difficult for brands to stand out and succeed longer term. Casper’s lackluster IPO in February 2020 is an example of a company that was highly overvalued by private investors before the company declared it lost substantial money in its first year, thus revealing a suffering business.

The table below shows the amounts in funding raised by D2C brands and the acquisitions by more established CPGs, all indicating an investment landscape focused on longer term consolidation and sustainability:

EDGE, 2020. Future Retail Disruption Report, 2020

It is certainly easy to start a D2C online business, but it is much harder to scale a business and sustain its growth than it was 10 years ago. The way brands will address a D2C business model is what will make them innovative and successful.

As previously mentioned, there are several benefits that come with D2C propositions and a multitude of tech enablers that allow to quickly ‘play’ in this field and scale globally. However, for D2C leaders to succeed, some key shifts and new principles should be adopted:

Omnichannel

Although the high street has experienced some significant challenges and changes this year, innovative brands are still leveraging the opportunity provided by physical spaces. Consumers are placing increasing value on unique, personalized, engaging experiences over factors such as price, product or brands.

This creates new opportunities for D2C brands to create innovative concept stores or pop-up destinations aimed at complementing their online offering by delivering unique experiences. Being able to deliver hyperlocal and personalised experiences becomes a key component of successful omnichannel models.

Physical destinations are becoming great marketing channels and IRL (In Real Life) retail is a good avenue to counteract the ever increasing costs and competition of online advertising.

Additionally, rethinking physical spaces and their usage is also part of the creative thinking and flexibility required by brands to adapt to new trends. For example companies like Lindt and Levi’s were able to leverage some of their closed physical locations to fulfil online orders during the pandemic this year, repurposing their spaces to have a bigger role in their distribution channels.

Build a relationship with and nurture the community

As mentioned earlier, one of the key advantages of direct-to-consumer stems from the opportunity to build one-to-one relationships with consumers. Specifically, the opportunity generated by creating a conversation, a dialogue with customers to understand how to best address their needs and take into account their feedback.

Investing into CRM and in building loyalty programs will become a key differentiator for brands looking to succeed through their D2C models. The biggest challenge will likely be to ensure an ‘intimate-enough’ relationship with a customer as brands scale and grow globally.

Consider vertical integration

Because of the increased competition for digital impressions that more mature and established brands face against newer, niche brands it is important to look for ways to preserve margins and ensure longer term profitability.

Customer acquisition costs are ever increasing and vertically integrating manufacturing processes, distribution and product supply is an important strategy to counteract those costs, thus preserving margins.

Prepare for new technologies and voice commerce

Voice interfaces are reshaping commerce and will have a substantial impact on marketing / communications’ strategies in the next decade. Brands need to be thinking about the next platform shift or they will lag behind.

In this context, the term D2C will shift towards one that requires brands to adopt new communication and engagement strategies, thinking about how to leverage new technologies to respond to more demanding consumers.

Highly innovative digitally native brands are already experimenting with voice commerce, augmented reality-enabled online-to-offline experiences and artificial intelligence. Through headless commerce and progressive web applications, brands now have the chance to offer unique, creative, hyper-personalised experiences with almost limitless possibilities.

Success requires flexibility, long-term visions and a close relationship with consumers. In this respect, D2C is assuming a different role. One which has to be incorporated within wider omnichannel models and one that requires both an understanding of evergreen business basics as well as new emerging technologies and consumptions’ shifts.